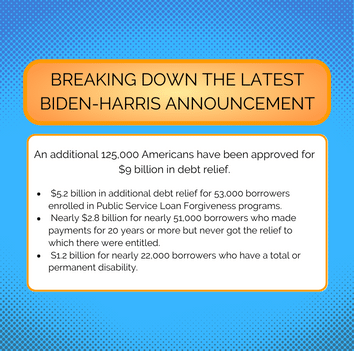

How Student Loan Forgiveness Can Transform Your Life

The best part of our job here at My Education Solutions is helping our clients achieve the goal of complete student loan forgiveness. There’s no better feeling than seeing the joy on someone’s face who finally reaches the end of that long road and gets back their...

Overcoming the Overwhelm of Student Loan Debt

My Education Solutions Answers Frequently Asked Questions (FAQs) Are you feeling the overwhelm of your student loan debt? You’re not alone. Navigating the labyrinth of the repayment process can be complex, leaving even the most ambitious feeling buried. Whether...

Empowering Financial Freedom

Being thankful during the holiday season transcends the mere act of expressing gratitude; it embodies a profound appreciation for the blessings and connections that enrich our lives. It’s a time when we reflect on the warmth of family gatherings, the joy of...

From Debt to Dream Home: Michael’s Journey to Financial Freedom Through Student Loan Forgiveness

Over 43 million Americans are grappling with the burden of student loan debt, a staggering sum that surpasses $1.7 trillion. With an average individual debt of $37,787, the weight of monthly payments can take a toll on both financial stability and mental well-being....