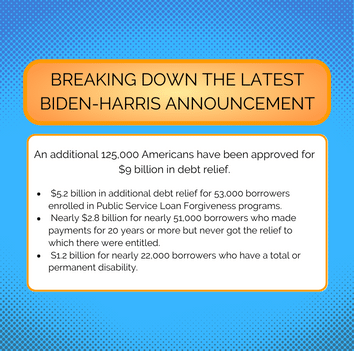

The Biden-Harris administration announced yesterday that an additional 125,000 Americans have been approved for $9 billion in debt relief through income-driven repayment (IDR) and Public Service Loan Forgiveness (PSLF), and granted automatic relief for borrowers with total and permanent disabilities.

Here is a breakdown of the debt relief by the numbers:

- $5.2 billion in additional debt relief for 53,000 borrowers under Public Service

Loan Forgiveness programs. - Nearly $2.8 billion in new debt relief for nearly 51,000 borrowers through fixes to income-driven repayment. These are borrowers who made 20 years or more of payments but never got the relief they were entitled to.

- S1.2 billion for nearly 22,000 borrowers who have a total or permanent disability.

While this announcement will be welcome news to many, it will still have little impact on the vast majority of borrowers. Who is actually eligible to access these relief funds?

To participate in a Public Service Loan Forgiveness program you must be a federal, state, local, or tribal government employee for a total of ten years. Income-driven repayment relief only applies to borrowers who have made payments for 20 years or more. The last category of borrowers must have a permanent disability as defined by the Social Security Administration.

If you don’t fall into any of these categories then you must start making payments on your student loans this month. Interest on these loans has already started accruing so it’s important to make a plan now and act by exploring your repayment options.

An MES Advisor can give you the latest information on forgiveness programs and check your eligibility at no cost. Speak to an Advisor at 210-812-3200.